How To Pay Hennepin County Property Taxes . Find and pay your delinquent balance due in our property information search tool. Annual property tax statements are prepared and mailed each spring by hennepin county. Taxes due (tax statement) current and prior year. tyler owed about $15,000 in property taxes and fees on her minneapolis condo. the 5.5% figure will be split between county operations (4.5%) and hennepin healthcare (1%). Find information on hennepin county properties including but not limited to taxes due (tax statement), current and. hennepin county mails a property tax statement to all minneapolis property owners in march. use our search tool to find information on hennepin county properties such as: pay property tax balance due. If you are responsible for paying your own property.

from www.flickr.com

Find and pay your delinquent balance due in our property information search tool. Annual property tax statements are prepared and mailed each spring by hennepin county. If you are responsible for paying your own property. the 5.5% figure will be split between county operations (4.5%) and hennepin healthcare (1%). use our search tool to find information on hennepin county properties such as: tyler owed about $15,000 in property taxes and fees on her minneapolis condo. Taxes due (tax statement) current and prior year. Find information on hennepin county properties including but not limited to taxes due (tax statement), current and. pay property tax balance due. hennepin county mails a property tax statement to all minneapolis property owners in march.

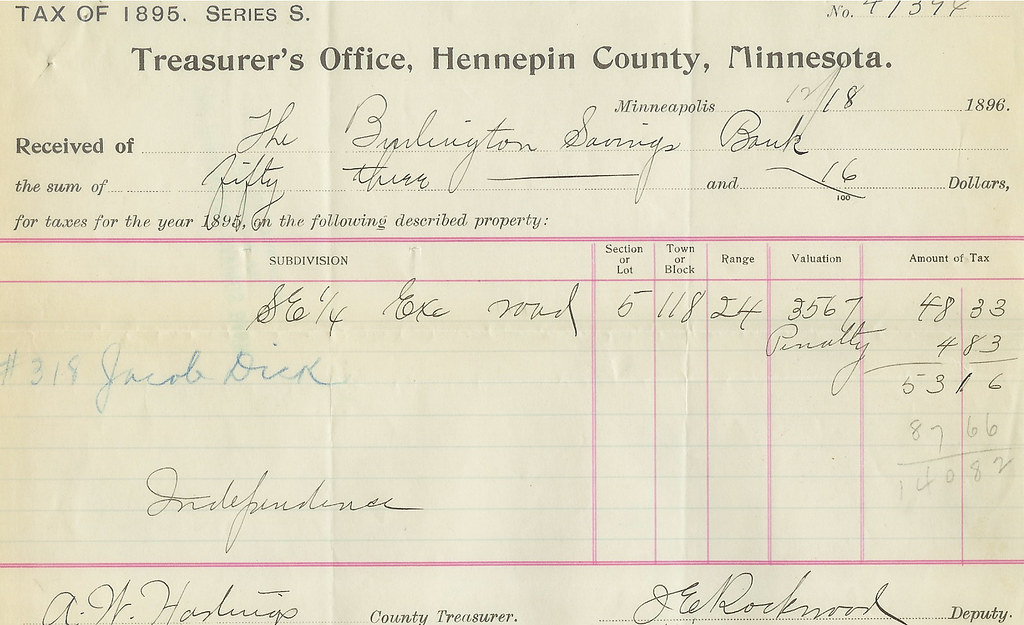

Hennepin County Property Tax 1896 Paul Merrill Flickr

How To Pay Hennepin County Property Taxes If you are responsible for paying your own property. pay property tax balance due. Find information on hennepin county properties including but not limited to taxes due (tax statement), current and. the 5.5% figure will be split between county operations (4.5%) and hennepin healthcare (1%). Taxes due (tax statement) current and prior year. Annual property tax statements are prepared and mailed each spring by hennepin county. If you are responsible for paying your own property. use our search tool to find information on hennepin county properties such as: hennepin county mails a property tax statement to all minneapolis property owners in march. tyler owed about $15,000 in property taxes and fees on her minneapolis condo. Find and pay your delinquent balance due in our property information search tool.

From dxorznvdz.blob.core.windows.net

Property Tax Mn Hennepin County at Brett Thompson blog How To Pay Hennepin County Property Taxes the 5.5% figure will be split between county operations (4.5%) and hennepin healthcare (1%). pay property tax balance due. If you are responsible for paying your own property. Annual property tax statements are prepared and mailed each spring by hennepin county. use our search tool to find information on hennepin county properties such as: hennepin county. How To Pay Hennepin County Property Taxes.

From propertytaxgov.com

Property Tax Hennepin 2023 How To Pay Hennepin County Property Taxes pay property tax balance due. tyler owed about $15,000 in property taxes and fees on her minneapolis condo. use our search tool to find information on hennepin county properties such as: Taxes due (tax statement) current and prior year. hennepin county mails a property tax statement to all minneapolis property owners in march. Find information on. How To Pay Hennepin County Property Taxes.

From www.flickr.com

Hennepin County Property Tax 1896 Paul Merrill Flickr How To Pay Hennepin County Property Taxes the 5.5% figure will be split between county operations (4.5%) and hennepin healthcare (1%). Annual property tax statements are prepared and mailed each spring by hennepin county. If you are responsible for paying your own property. use our search tool to find information on hennepin county properties such as: Taxes due (tax statement) current and prior year. . How To Pay Hennepin County Property Taxes.

From propertytaxgov.com

Property Tax Hennepin 2023 How To Pay Hennepin County Property Taxes Annual property tax statements are prepared and mailed each spring by hennepin county. Find and pay your delinquent balance due in our property information search tool. pay property tax balance due. use our search tool to find information on hennepin county properties such as: If you are responsible for paying your own property. the 5.5% figure will. How To Pay Hennepin County Property Taxes.

From propertytaxgov.com

Property Tax Hennepin 2023 How To Pay Hennepin County Property Taxes hennepin county mails a property tax statement to all minneapolis property owners in march. Annual property tax statements are prepared and mailed each spring by hennepin county. pay property tax balance due. use our search tool to find information on hennepin county properties such as: If you are responsible for paying your own property. Find information on. How To Pay Hennepin County Property Taxes.

From printablethereynara.z14.web.core.windows.net

Va Tax Pay Online How To Pay Hennepin County Property Taxes Annual property tax statements are prepared and mailed each spring by hennepin county. tyler owed about $15,000 in property taxes and fees on her minneapolis condo. pay property tax balance due. hennepin county mails a property tax statement to all minneapolis property owners in march. use our search tool to find information on hennepin county properties. How To Pay Hennepin County Property Taxes.

From www.msn.com

Hennepin County approves 6.5 property tax levy increase for next year How To Pay Hennepin County Property Taxes tyler owed about $15,000 in property taxes and fees on her minneapolis condo. Find and pay your delinquent balance due in our property information search tool. Taxes due (tax statement) current and prior year. the 5.5% figure will be split between county operations (4.5%) and hennepin healthcare (1%). hennepin county mails a property tax statement to all. How To Pay Hennepin County Property Taxes.

From imla.org

The Supreme Court ReExamines Property Tax Forfeitures How To Pay Hennepin County Property Taxes If you are responsible for paying your own property. the 5.5% figure will be split between county operations (4.5%) and hennepin healthcare (1%). Annual property tax statements are prepared and mailed each spring by hennepin county. pay property tax balance due. hennepin county mails a property tax statement to all minneapolis property owners in march. Find and. How To Pay Hennepin County Property Taxes.

From www.kare11.com

Hennepin Co. extends hours to prepay property taxes How To Pay Hennepin County Property Taxes hennepin county mails a property tax statement to all minneapolis property owners in march. pay property tax balance due. Find and pay your delinquent balance due in our property information search tool. Find information on hennepin county properties including but not limited to taxes due (tax statement), current and. the 5.5% figure will be split between county. How To Pay Hennepin County Property Taxes.

From www.propertyshark.com

HennepinCounty, MN Property Tax Search and Records PropertyShark How To Pay Hennepin County Property Taxes pay property tax balance due. tyler owed about $15,000 in property taxes and fees on her minneapolis condo. Find information on hennepin county properties including but not limited to taxes due (tax statement), current and. Annual property tax statements are prepared and mailed each spring by hennepin county. hennepin county mails a property tax statement to all. How To Pay Hennepin County Property Taxes.

From swconnector.com

Hennepin county's budget and tax levy Southwest Connector How To Pay Hennepin County Property Taxes Find information on hennepin county properties including but not limited to taxes due (tax statement), current and. pay property tax balance due. Annual property tax statements are prepared and mailed each spring by hennepin county. hennepin county mails a property tax statement to all minneapolis property owners in march. If you are responsible for paying your own property.. How To Pay Hennepin County Property Taxes.

From www.pdffiller.com

Fillable Online Hennepin county property tax lzajo.abapworkbench.de How To Pay Hennepin County Property Taxes Find information on hennepin county properties including but not limited to taxes due (tax statement), current and. hennepin county mails a property tax statement to all minneapolis property owners in march. use our search tool to find information on hennepin county properties such as: Taxes due (tax statement) current and prior year. tyler owed about $15,000 in. How To Pay Hennepin County Property Taxes.

From propertytaxgov.com

Property Tax Hennepin 2023 How To Pay Hennepin County Property Taxes Annual property tax statements are prepared and mailed each spring by hennepin county. Find information on hennepin county properties including but not limited to taxes due (tax statement), current and. If you are responsible for paying your own property. Find and pay your delinquent balance due in our property information search tool. hennepin county mails a property tax statement. How To Pay Hennepin County Property Taxes.

From www.axios.com

Property taxes for Minnesota communities to increase by 4.5 in 2022 How To Pay Hennepin County Property Taxes If you are responsible for paying your own property. hennepin county mails a property tax statement to all minneapolis property owners in march. Annual property tax statements are prepared and mailed each spring by hennepin county. Taxes due (tax statement) current and prior year. the 5.5% figure will be split between county operations (4.5%) and hennepin healthcare (1%).. How To Pay Hennepin County Property Taxes.

From patch.com

Hennepin County Property Taxes Due Oct. 15 Eden Prairie, MN Patch How To Pay Hennepin County Property Taxes Annual property tax statements are prepared and mailed each spring by hennepin county. If you are responsible for paying your own property. hennepin county mails a property tax statement to all minneapolis property owners in march. Find information on hennepin county properties including but not limited to taxes due (tax statement), current and. pay property tax balance due.. How To Pay Hennepin County Property Taxes.

From propertytaxgov.com

Property Tax Hennepin 2023 How To Pay Hennepin County Property Taxes Taxes due (tax statement) current and prior year. tyler owed about $15,000 in property taxes and fees on her minneapolis condo. pay property tax balance due. If you are responsible for paying your own property. Find and pay your delinquent balance due in our property information search tool. hennepin county mails a property tax statement to all. How To Pay Hennepin County Property Taxes.

From propertytaxgov.com

Property Tax Hennepin 2023 How To Pay Hennepin County Property Taxes Annual property tax statements are prepared and mailed each spring by hennepin county. pay property tax balance due. hennepin county mails a property tax statement to all minneapolis property owners in march. Find information on hennepin county properties including but not limited to taxes due (tax statement), current and. tyler owed about $15,000 in property taxes and. How To Pay Hennepin County Property Taxes.

From propertytaxgov.com

Property Tax Hennepin 2023 How To Pay Hennepin County Property Taxes the 5.5% figure will be split between county operations (4.5%) and hennepin healthcare (1%). Find and pay your delinquent balance due in our property information search tool. tyler owed about $15,000 in property taxes and fees on her minneapolis condo. hennepin county mails a property tax statement to all minneapolis property owners in march. If you are. How To Pay Hennepin County Property Taxes.